GENIUS Act considers stablecoins as means of payment on blockchain

- latinlawyer

- Aug 22, 2025

- 4 min read

On July 17, the US Congress approved by 308 votes to 122 the Guiding and Establishing National Innovation for US Stablecoins Act, GENIUS Act , to modernize the electronic payment system by incorporating stablecoin transactions .

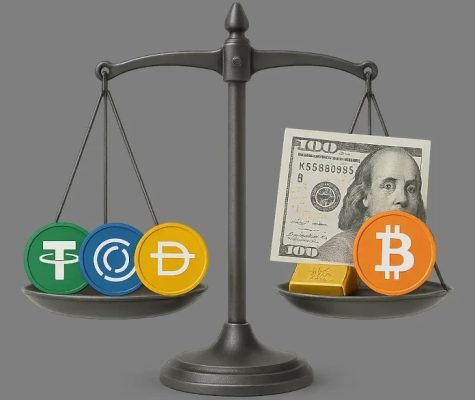

After a decade of discussions about their legal nature, legally permitted stablecoins now represent a new digital means of payment that can be converted into a guaranteed fixed value, serving both savings and domestic and international transactions.

With this law, Bank of America expects a 30% increase in the stablecoin supply in a current market of $270 billion already issued. The bank also foresees an immediate consolidation of this digital asset market when the bill known as the Clarity Act is adopted, as it will resolve classification conflicts regarding its multiple legal entities. JP Morgan, on the other hand, expects the stablecoin market to double by 2028, with consistent application in international trade. With this progression, for example, it is very likely that the BRICS' efforts to compete with the international use of the dollar with a digital currency will be thwarted.

These digital assets, which guarantee their parity against the dollar and/or U.S. Treasury bills, had been equated with securities, deposits, or bank debts. This law represents a convertible means of payment that is not legal tender but offers identical functionality. Their legally fixed parity ("flat-pegged-redeemable") enables immediate and free payment for any transaction, using the centrality of the blockchain .

Legal updates for stablecoins and issuing entities:

They can only be issued by entities approved by the Office of the Comptroller of the Currency (OCC) in principle operating a centralized blockchain ;

Foreign entities may offer them in the US provided they are subject to similar control in their country of origin, recognized in the US by the OCC with periodic review of their obligation to report financial information;

They must be fully backed by authorized liquid financial assets;

They must report their reserves monthly, subject to monthly certification under criminal liability;

They are prohibited from rehypothecation, which is, in the crypto market, the repeated use of the same asset as a different convertible security;

They must meet liquidity, risk and quality standards for stablecoins ;

They must guarantee an information system for clients, protecting their assets as their own property;

If they issue more than $10 trillion, they are subject to federal oversight. Below that amount, issuance falls under state control. States report and submit their oversight system to the Treasury Department.

Restrictions on your legal naturalization:

Not all stablecoins are considered permitted means of payment , only those issued by controlled entities and centralized blockchain , being subsidiarily subject to the securities law;

By exclusion, the GeniUS Act provides that no bond, certificate of debt, or investment contract created or sold by a legally authorized issuer of payment stablecoins may qualify as a security under the updated definition;

If they are not issued by an authorized entity, they cannot be counted as cash, nor used as collateral for debt or commission payments, nor held in custody by designated brokers. In this case, they cannot function as a means of settling financial agreements or paying for infrastructure.

The GeniUS Act prohibits any speculation regarding the issuance of stablecoins , such as the proposal of an interest in buying or selling to accept a reduction in convertible collateral.

Main legal and financial effects:

SEC Directors Paul Atkinson and Hester Pierce personally petitioned Congress for the approval of the GeniUS Act, explaining that payment stablecoins play an essential role in the evolution of securities by allowing registered brokers to offer custody as long as they comply with the requirements of this new law;

Demand for US public debt securities, especially short-term bonds, will increase;

They will support the USD's hegemony in the international trade market;

They will atomize the holding of US public debt through the blockchain ;

Since stablecoin payments will be isolated from the speculation and volatility of decentralized blockchain operations (DeFi) , a significant diversion of funds could occur.

As financial and accounting assets, they offer savings capacity at a stable value, earning interest today at 4%. Indeed, your deposit on platforms like Coinbase or PayPal will earn interest like any other dollar deposit, although without Federal Reserve insurance.

In the event of insolvency, authorized issuers are subject to bankruptcy law to protect their customers. GeniUS also reforms Chapter 11 so that reserve stablecoins held by an authorized issuer and the securities used to back them are not part of the bankruptcy estate. Stablecoin holders receive preferential credit over and above bankruptcy administrative costs and fees.

The GeniUS Act's effective date will be the earlier of January 18, 2027, or the date 120 days after federal banking regulators issue implementing regulations. However, the issuance of payment stablecoins in the US is still permitted until that date. From the date of entry into force until July 18, 2028, they may be offered and sold through already authorized entities, and the aforementioned restrictions will apply from that date.

The integration of stablecoins into North American payment systems adds greater transparency to the digital asset market, predictability for cryptocurrencies, and new opportunities for businesses and customers to operate immediately on the blockchain without payment fees, and to settle their domestic and international contracts in stablecoins .

Comments